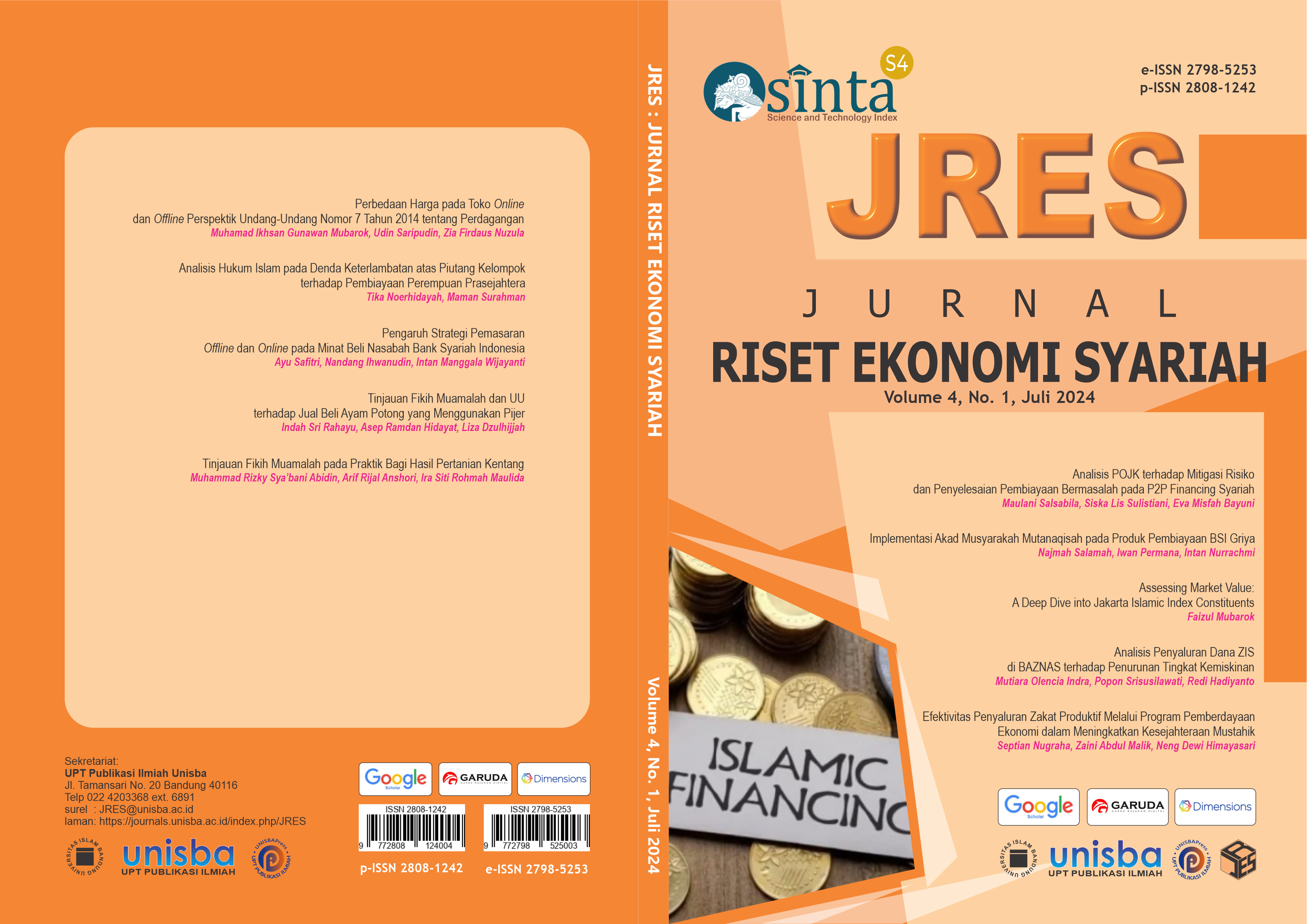

Assessing Market Value: A Deep Dive into Jakarta Islamic Index Constituents

DOI:

https://doi.org/10.29313/jres.v4i1.3983Keywords:

Company Size, Debt to Assets, Firm ValueAbstract

Abstrak. Secara keseluruhan, terdapat indikator perlambatan perekonomian global, dan beberapa negara mengalami kontraksi. Dampaknya adalah penurunan investasi, yang merupakan dampak lain yang tidak diinginkan. Tujuan dari penelitian ini untuk menganalisis pengaruh berbagai karakteristik perusahaan dalam Jakarta Islamic Index (JII) terhadap nilai perusahaan (TQ). Karakteristik tersebut antara lain ukuran perusahaan (SIZ), rasio utang terhadap aset (DAR), rasio lancar (CUR), dan rasio pengembalian atas aset (ROA). Penelitian ini menerapkan model efek acak data tahunan dari laporan keuangan sebelas perusahaan berbeda dari tahun 2011 hingga 2021. Temuan penelitian menunjukkan rasio utang terhadap aset dan rasio lancar merupakan indikator penting dari kesehatan dan nilai keuangan perusahaan secara keseluruhan. Kinerja perusahaan yang baik terangkum dalam nilai perusahaan, sehingga lebih mudah meyakinkan calon investor bahwa bisnis tersebut layak untuk dilakukan. Kekayaan pemegang saham perusahaan sebanding dengan nilai perusahaan.

Abstract. Overall, there have been indicators of a slowdown in the global economy, and several countries have actually seen contraction. Investment has dropped as a result, another unwelcome effect of the current crisis. The goal of this research is to determine the impact that various characteristics of the companies in the Jakarta Islamic Index (JII) have on their firm value (TQ). These characteristics include company size (SIZ), debt to assets ratio (DAR), current ratio (CUR), and return on assets ratio (ROA). Here, we apply a random effect model to the annual data from the financial statements of eleven distinct companies from 2011 to 2021. Findings suggest that the debt-to-asset ratio and the current ratio are important indicators of a company's overall financial health and value (TQ). Realizing the firm's full potential is crucial if it is to fulfill its major goals, which is why maximization of value is of such paramount importance. Good company performance is summarized in the firm value, making it simpler to convince potential investors that the business is worth their time. The wealth of the company's shareholders is proportional to the value of the company.

Downloads

References

Ahmed, H., & Elsayed, A. H. (2019). Are Islamic and conventional Capital Markets Decoupled? Evidence from Stock and Bonds/Sukuk Markets in Malaysia. Quarterly Review of Economics and Finance, 74, 56–66. https://doi.org/10.1016/j.qref.2018.04.005

Al Nasser, O. M., & Hajilee, M. (2016). Integration of Emerging Stock Markets with Global Stock Markets. Research in International Business and Finance, 36, 1–12. https://doi.org/10.1016/j.ribaf.2015.09.025

Alandejani, M., & Asutay, M. (2017). Nonperforming Loans in the GCC Banking Sectors: Does the Islamic Finance Matter? Research in International Business and Finance, 42(2), 832–854. https://doi.org/10.1016/j.ribaf.2017.07.020

Amara, N., Halilem, N., & Traoré, N. (2016). Adding Value to Companies’ Value Chain: Role of Business Schools Scholars. Journal of Business Research, 69(5), 1661–1668. https://doi.org/10.1016/j.jbusres.2015.10.035

Azamat, K., Galiya, J., Bezhan, R., & Nurdana, Z. (2023). The Impact of Intangible Assets on the Value of FMCG Companies Worldwide. Journal of Innovation and Knowledge, 8(1), 1–7. https://doi.org/10.1016/j.jik.2023.100330

Baud, C., Brivot, M., & Himick, D. (2019). Accounting Ethics and the Fragmentation of Value. Journal of Business Ethics, 168(2), 373–387. https://doi.org/10.1007/s10551-019-04186-9

Benczúr, P., Karagiannis, S., & Kvedaras, V. (2019). Finance and Economic Growth: Financing Structure and Non-Linear Impact. Journal of Macroeconomics, 62, 1–49. https://doi.org/10.1016/j.jmacro.2018.08.001

Benkraiem, R., Shuwaikh, F., Lakhal, F., & Guizani, A. (2022). Carbon Performance and Firm Value of the World’s Most Sustainable Companies. Economic Modelling, 116, 1–12. https://doi.org/10.1016/j.econmod.2022.106002

Cincinelli, P., Pellini, E., & Urga, G. (2022). Systemic Risk in the Chinese Financial System: A panel Granger Causality Analysis. International Review of Financial Analysis, 82, 1–17.

Deffi, L. S. R., Cahyono, D., & Aspirandi, R. M. (2020). Pengaruh Enterprise Risk Management Disclosure, Intellectual Capital Disclosure, dan Debt To Asset Ratio terhadap Nilai Perusahaan. Budgeting: Journal of Business, Management and Accounting, 1(2), 147–162.

Ellington, M. (2018). Financial Market Illiquidity Shocks and Macroeconomic Dynamics: Evidence from the UK. Journal of Banking and Finance, 89, 225–236. https://doi.org/10.1016/j.jbankfin.2018.02.013

Fikri, S. M. (2019). Ownership Concentration and Fund Performance in Conventional and Shariah Malaysian Mutual Funds. International Journal of Monetary Economics and Finance, 12(6), 467–497. https://doi.org/10.1504/IJMEF.2019.104672

Gazdar, K., & Cherif, M. (2015). Institutions and the Finance-growth Nexus: Empirical Evidence from MENA Countries. Borsa Istanbul Review, 15(3), 137–160. https://doi.org/10.1016/j.bir.2015.06.001

Grundy, B. D., & Verwijmeren, P. (2020). The External Financing of Investment. Journal of Corporate Finance, 65, 1–47. https://doi.org/10.1016/j.jcorpfin.2020.101745

Gu, T., Jiang, Y., & Simunic, D. (2022). The Value of the PCAOB’s International Audit Oversight on U.S. Listed Foreign Companies: Evidence from an Initial Enforcement Breakdown. Journal of Contemporary Accounting and Economics, 4, 1–25. https://doi.org/10.1016/j.jcae.2022.100349

Guzman, M., Ocampo, J. A., & Stiglitz, J. E. (2018). Real Exchange Rate Policies for Economic Development. World Development, 110, 51–62. https://doi.org/10.1016/j.worlddev.2018.05.017

Hadian, A., & Adaoglu, C. (2020). The Effects of Financial and Operational Hedging on Company Value: The Case of Malaysian Multinationals. Journal of Asian Economics, 70, 1–20. https://doi.org/10.1016/j.asieco.2020.101232

Hernandez, D., & Vadlamannati, K. C. (2017). Politics of Religiously Motivated Lending: An Empirical Analysis of Aid Allocation by the Islamic Development Bank. Journal of Comparative Economics, 45(4), 910–929. https://doi.org/10.1016/j.jce.2016.09.008

Himmati, R., Nabila, R., & Maslinda, L. M. (2021). Factors Affecting Company Values in the Companies Listed in the Jakarta Islamic Index. Equilibrium: Jurnal Ekonomi Syariah, 9(2), 275–294. https://doi.org/10.21043/equilibrium.v9i2.11991

Hosen, M. N., & Muhari, S. (2017). Liquidity and Capital of Islamic Banks in Indonesia. Signifikan: Jurnal Ilmu Ekonomi, 6(1), 49–68. https://doi.org/10.15408/sjie.v6i1.4405

Huang, Z. xiong, Tang, Q., & Huang, S. (2020). Foreign Investors and Stock Price Crash Risk: Evidence from China. Economic Analysis and Policy, 68, 210–223. https://doi.org/10.1016/j.eap.2020.09.016

Irman, M., Purwati, A. A., & Juliyanti. (2020). Analysis On The Influence Of Current Ratio, Debt to Equity Ratio and Total Asset Turnover Toward Return On Assets On The Otomotive and Component Company That Has Been Registered In Indonesia Stock Exchange Within 2011-2017. International Journal of Economics Development Research, 1(1), 36–44.

Izzeldin, M., Johnes, J., Ongena, S., Pappas, V., & Tsionas, M. (2021). Efficiency Convergence in Islamic and Conventional Banks. Journal of International Financial Markets, Institutions and Money, 70, 1–24. https://doi.org/10.1016/j.intfin.2020.101279

Karim, M. M., Kawsar, N. H., Ariff, M., & Masih, M. (2022). Does Implied Volatility (or fear index) Affect Islamic Stock Returns and Conventional Stock Returns Differently? Wavelet-based Granger-Causality, Asymmetric Quantile Regression and NARDL Approaches. Journal of International Financial Markets, Institutions and Money, 77, 1–16.

Li, S., Li, T., Yang, J., & Zao, S. (2021). Tobin’s and Corporate Investment with a Pandemic Shock. Economics Letters, 209, 1–16.

Li, Z., Wang, F., & Dong, X. (2016). Are all Investment Decisions to Subscribe to New Stocks Mindless? China Journal of Accounting Research, 9(4), 283–304. https://doi.org/10.1016/j.cjar.2016.09.002

Mahdi, I. B. S., & Abbes, M. B. (2018). Relationship between Capital, Risk and Liquidity : a Comparative Study between Islamic and Conventional Banks in MENA Region. Research in International Business and Finance, 45, 588–596. https://doi.org/10.1016/j.ribaf.2017.07.113

Mohammad, S., Asutay, M., Dixon, R., & Platonova, E. (2020). Liquidity Risk Exposure and its Determinants in the Banking Sector: A Comparative Analysis between Islamic, Conventional and Hybrid Banks. Journal of International Financial Markets, Institutions and Money, 66, 1–20. https://doi.org/10.1016/j.intfin.2020.101196

Niyas, N., & Kavida, V. (2023). Impact of Financial Brand Values on Firm Profitability and Firm Value of Indian FMCG Companies. IIMB Management Review, 2, 1–18. https://doi.org/10.1016/j.iimb.2023.01.001

Pantouvakis, A., & Syntychaki, A. (2022). Selecting the Right Partners to Maximize Value for Shipping Companies: An Exploratory Study. Research in Transportation Business and Management, 43, 1–9. https://doi.org/10.1016/j.rtbm.2021.100697

Rahman, M. M., Zheng, C., Ashraf, B. N., & Rahman, M. M. (2018). Capital Requirements, The Cost of Financial Intermediation and Bank Risk-taking : Empirical Evidence from Bangladesh. Research in International Business and Finance, 44, 488–503. https://doi.org/10.1016/j.ribaf.2017.07.119

Rahmanto, D. N. A., Fasa, M. I., & Rijal, K. (2020). Source of Funds and Islamic Insurance Growth: Investment Returns as a Mediation. Al-Uqud : Journal of Islamic Economics, 4(1), 104–114. https://doi.org/10.26740/al-uqud.v4n1.p104-114

Saksonova, S. (2014). The Role of Net Interest Margin in Improving Banks’ Asset Structure and Assessing the Stability and Efficiency of their Operations. Procedia - Social and Behavioral Sciences, 150, 132–141. https://doi.org/10.1016/j.sbspro.2014.09.017

Shafron, E. (2019). Investor Tastes: Implications for Asset Pricing in the Public Debt Market. Journal of Corporate Finance, 55, 6–27. https://doi.org/10.1016/j.jcorpfin.2018.08.006

Sonaglio, C. M., Campos, A. C., & Braga, M. J. (2016). Effects of Interest and Exchange Rate Policies on Brazilian Exports. EconomiA, 17(1), 77–95. https://doi.org/10.1016/j.econ.2016.01.002

Suhadak, Kurniaty, Handayani, S. R., & Rahayu, S. M. (2019). Stock Return and Financial Performance as Moderation Variable in Influence of Good Corporate Governance Towards Corporate Value. Asian Journal of Accounting Research, 4(1), 18–34. https://doi.org/10.1108/AJAR-07-2018-0021

Suhendry, W., Toni, N., & Simorangkir, E. N. (2021). Effect of Debt to Equity Ratio and Current Ratio on Company Value with Return on Assets as Intervening Variable in Consumer Goods Industrial Companies Listed on the Indonesia Stock Exchange for the 2015–2018 Period. Journal of Economics, Finance And Management Studies, 4(8), 1444–1449. https://doi.org/10.47191/jefms/v4-i8-22

Sun, C., Zhan, Y., & Du, G. (2020). Can Value-added Tax Incentives of New Energy Industry Increase Firm’s Profitability? Evidence from Financial Data of China’s Listed Companies. Energy Economics, 86, 1–13. https://doi.org/10.1016/j.eneco.2019.104654

Tan, Z., Yan, Z., & Zhu, G. (2019). Stock Selection with Random Forest: An Exploitation of Excess Return in the Chinese Stock Market. Heliyon, 5(8), e02310. https://doi.org/10.1016/j.heliyon.2019.e02310

Tielmann, A., & Schiereck, D. (2017). Arising Borders and the Value of Logistic Companies: Evidence from the Brexit Referendum in Great Britain. Finance Research Letters, 20, 22–28. https://doi.org/10.1016/j.frl.2016.08.006

Wajdi, M. (2019). On the co-movements among Stock Prices and Exchange Rates Cointegration : a VAR / VECM Approach. Journal of Finance and Investment Analysis, 8(1), 61–75.

Wayan, N., Yundhari, T., Bagus, I., & Sedana, P. (2020). The Effect Of Profitability, Growth, And Asset Structure On Company Value With Capital Structure As Mediation On Consumer Goods Companies In Indonesia Stock Exchange. International Journal of Business Marketing and Management, 5(11), 2456–4559. www.idx.co.id

Werner, R. (2016). A Lost Century in Economics: Three Theories of Banking and the Conclusive Evidence. International Review of Financial Analysis, 46, 361–379. https://doi.org/10.1016/j.irfa.2015.08.014

Xu, C., Hu, Z., & Liang, S. (2021). Board Faultlines and the Value of Cash Holdings: Evidence from Chinese Listed Companies. China Journal of Accounting Research, 14(1), 25–42. https://doi.org/10.1016/j.cjar.2021.02.001

Yuliani, Edward, Y. R., & Simorangkir, E. N. (2020). Effect of Current Ratio and Debt to Equity on Price to Book Value with Return on Equity as an Intervening Variable in the Consumer Goods Industry Sector in Companies Listed on the IDX in the Period 2016-2018. Journal of Research in Business, Economics, and Education, 2(5), 1–11.

Zhang, C., Zheng, Y., Fan, S., & Wu, Y. (2022). Integration of Two Industries, Risk-taking and Manufacturing Enterprise Value: An Empirical Investigation Based on Chinese Listed Companies. Finance Research Letters, 4, 1–6. https://doi.org/10.1016/j.frl.2022.103592